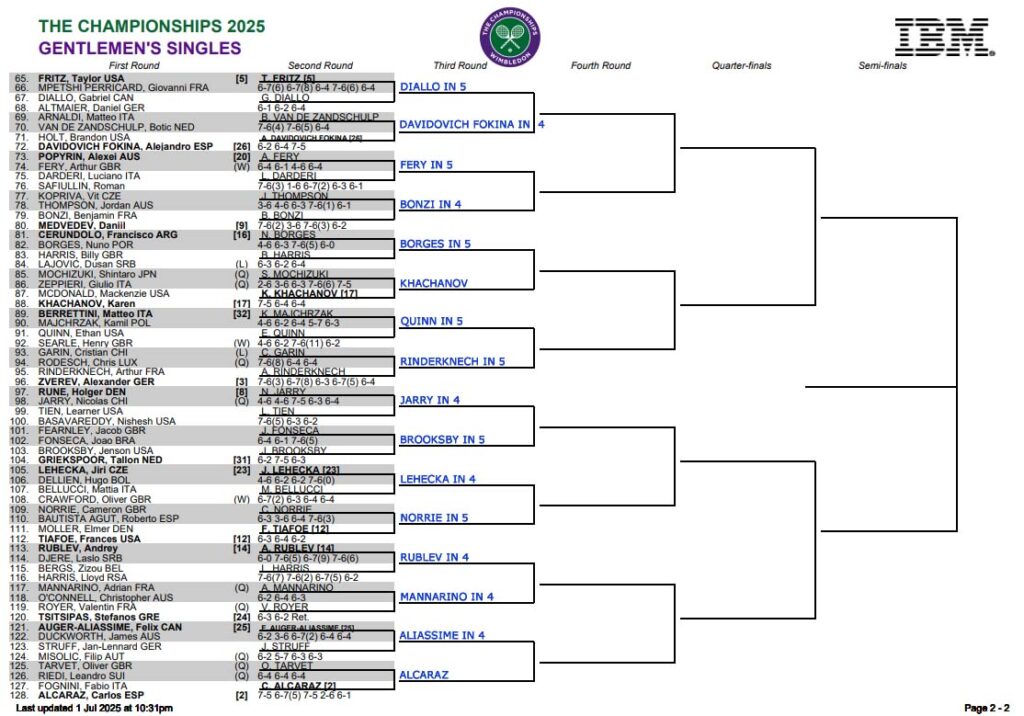

ATP Wimbledon, Second Round Predictions

These predictions are aimed at traders rather than punters. When assessing a match, I initially look for 2 things. Who do I think will win and how competitive will the other player be?

Use them for straight bets if you wish but please bear in mind that is not what they are intended for.

ATP Wimbledon, Second Round Predictions Read More »